Seamless International Transfers with Xe: A Close-Up Look

In today's fast-paced world, transferring money internationally shouldn't be a headache. As someone who has extensively explored options for international money transfers, I found Xe to be not only reliable but also straightforward and secure. Here's a deep dive into why Xe International Money Transfer might just be the ideal choice for your financial transactions.

Navigating Exchange Rates: Why It Matters

Have you ever wondered why exchange rates are so crucial when transferring money internationally? Let me tell you, they can make a significant difference in your savings. As a financial analyst once said,

"Exchange rates can make or break your transfer savings."

This couldn't be more accurate.

Understanding the Importance of Comparing Exchange Rates

When you're sending money across borders, every cent counts. Exchange rates determine how much your recipient will actually receive. If you don't compare rates, you might end up losing a chunk of your hard-earned money. Imagine transferring a large sum and realizing later that you could have saved a lot by choosing a different service provider. It's like buying a car without checking other dealerships—you're likely to miss out on a better deal.

How Xe Provides Competitive Exchange Rates

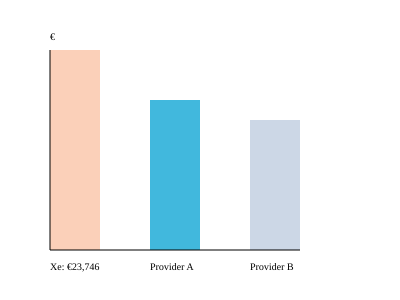

Now, let's talk about Xe. This platform stands out by allowing users to compare exchange rates from various service providers. It's like having a personal financial advisor who helps you make the best decision. On March 9, 2023, for instance, a recipient could receive €23,746 via Xe, compared to lower amounts from other providers. That's a tangible saving!

Xe has been in the business for over 30 years, consistently maintaining a competitive edge. Their long-standing presence in the market speaks volumes about their reliability and customer satisfaction. Over the years, they've built a reputation for offering some of the best rates, ensuring that users get the most out of their transfers.

Real-Life Comparisons for Better Understanding

Let's dive into a real-life scenario. Imagine you're transferring money to a family member abroad. You check Xe's rates and notice that you can send €23,746, whereas other services offer much less. This difference is not just a number; it's potential savings that could be used elsewhere. Maybe a family dinner, a small trip, or even reinvestment.

Xe's platform is user-friendly, making it easy for anyone to navigate and compare rates. It's like shopping for groceries with a price comparison app—simple, efficient, and rewarding. You get to see the potential savings right in front of you, empowering you to make informed decisions.

Consistent Customer Satisfaction

Over the years, Xe has garnered positive reviews from users worldwide. Their commitment to providing competitive rates and excellent customer service has kept them at the forefront of the industry. Customers appreciate the transparency and ease of use that Xe offers, making it a preferred choice for many.

But don't just take my word for it. Try it out yourself and see the difference. With Xe, you're not just transferring money; you're making a smart financial decision.

In conclusion, understanding and comparing exchange rates is vital for maximizing your savings during international money transfers. Xe's platform not only offers competitive rates but also provides a clear picture of potential savings. With over 30 years in the business, Xe remains a trusted choice for many, ensuring that your money goes further.

Step-by-Step Money Transfer Simplified

Have you ever wondered how to transfer money internationally without a hitch? Well, let me share my experience with Xe, a platform that has truly simplified this process. With Xe, sending money across borders is not just easy but also secure. Let's dive into the six-step process that makes this possible.

1. Signing Up

First things first, you need to sign up. It's free and straightforward. Just like setting up an email account, you provide some basic information. This step is crucial because it sets the foundation for all your future transactions. It's like getting your passport ready before a trip.

2. Obtaining Quotes

Next, you get a quote. Xe allows you to compare exchange rates, ensuring you get the best deal. Imagine shopping for groceries and finding the best price for your favorite cereal. That's what Xe does for your money transfers. It shows you how much your recipient will get, helping you make informed decisions.

3. Inputting Recipient Details

Once you've got your quote, it's time to input the recipient's details. This step is like addressing a letter. You need to ensure all the information is correct to avoid any delays. It's simple: name, bank details, and you're good to go.

4. Identity Verification

Now, this is where Xe shines. Identity verification is crucial. It's like showing your ID at the airport. Xe uses this step to protect your data and ensure the security of your transfer. "Security begins with simple steps, ensuring peace of mind for every transaction," says a Customer Experience Expert. This step reassures you that your money is in safe hands.

5. Confirming the Quote

After verifying your identity, you confirm the quote. Think of it as double-checking your shopping list before heading to the checkout. This step ensures everything is in order before the money leaves your account.

6. Tracking the Transfer

Finally, you can track your transfer. Xe provides a tracking feature that lets you know where your money is at all times. It's like tracking a package delivery, giving you peace of mind that your funds are on their way.

Here's a quick overview of the process:

Step | Description |

|---|---|

1. Signing Up | Free and straightforward registration. |

2. Obtaining Quotes | Compare exchange rates for the best deal. |

3. Inputting Recipient Details | Provide recipient's name and bank details. |

4. Identity Verification | Ensures security and data protection. |

5. Confirming the Quote | Double-check details before sending. |

6. Tracking the Transfer | Monitor the transfer's progress. |

Payment Options

Xe offers various payment options to suit your needs. Whether you prefer Direct Debit, wire transfers, or card payments, Xe has got you covered. Each option has its processing time and potential fees. For instance, card payments are quick—often under 24 hours—but might cost a bit more. On the other hand, Direct Debit and wire transfers could take up to four business days. It's like choosing between express and standard shipping for your online purchases.

In conclusion, Xe's systematic approach makes transferring money internationally a breeze. From signing up to tracking your transfer, each step is designed to ensure efficiency and security. And with identity verification, you can rest assured that your data is protected. So, if you're looking for a reliable way to send money abroad, give Xe a try. It's as easy as pie!

Beyond Basic Transfers: Exploring Payment Flexibility

When it comes to transferring money internationally, the options can sometimes feel overwhelming. But with Xe, the process is streamlined and versatile, offering a range of payment methods to suit different needs. Whether you're sending money to family overseas or paying for a service in another country, Xe has you covered. Let's dive into the various payment options and processing times that Xe offers, and see how they can make your life easier.

Understanding Xe's Versatile Payment Options

Xe provides a plethora of payment methods, ensuring users can choose what best suits their needs. From Direct Debit (ACH) to wire transfers, and even cash pickups and mobile wallets, the choices are plenty. This flexibility is a game-changer for many. As a Financial Services Expert once said,

"Versatility in payment options gives users the freedom and flexibility to choose."

And isn't that what we all want? The freedom to choose how we manage our finances.

Processing Times: What to Expect

Now, let's talk about processing times. It's crucial to know how long your money will take to reach its destination. For card payments, you're looking at less than 24 hours. That's pretty quick, right? However, if you're opting for Direct Debit or wire transfers, it might take a bit longer—up to four business days. It's a trade-off between speed and cost, and understanding this can help you plan better.

Regional Transfer Limits: Know Your Boundaries

Another important aspect to consider is regional transfer limits. These limits can impact how much you can send based on your location. For instance, in the UK and Europe, the limit is £350,000 GBP. In the US, it's $535,000 USD. Knowing these limits can help you avoid any surprises and ensure your transactions go smoothly.

Mobile Wallets and Cash Pickups: Accessibility at Its Best

One of the standout features of Xe is its ability to send money directly to mobile wallets in over 35 countries. This is particularly useful for recipients who may not have access to traditional banking services. It's quick, it's easy, and it's incredibly convenient. Plus, if you're dealing with someone who prefers physical cash, Xe's cash pickup option is a lifesaver. The process is simple: select an amount, generate a PIN, and share it with the recipient. They can then collect the cash at a specified location. It's all about making money transfers accessible to everyone.

Conclusion: Why Xe Stands Out

In conclusion, Xe International Money Transfer offers a comprehensive service that caters to both personal and business needs. With over 30 years of experience, they have honed their services to provide not just fast and reliable transfers, but also a range of options that give users the flexibility they need. Whether it's the quick processing times of card payments, the extensive reach of mobile wallets, or the convenience of cash pickups, Xe has positioned itself as a trusted choice in the money transfer space.

So, next time you're looking to send money internationally, consider Xe. With their competitive exchange rates and commitment to security, they offer a service that's hard to beat. After all, in a world where financial transactions are becoming increasingly complex, having a reliable partner like Xe can make all the difference.

TL;DR: Xe International Money Transfer offers competitive rates, a user-friendly platform, and secure international transactions, making it a top choice in the global money transfer space.

Comments

Post a Comment